The Netherlands is working to protect its climate-vulnerable neighbourhoods

- The Netherlands is one of the most vulnerable countries in the world to flood risk, with around 60% of its population and its economy located below sea level.

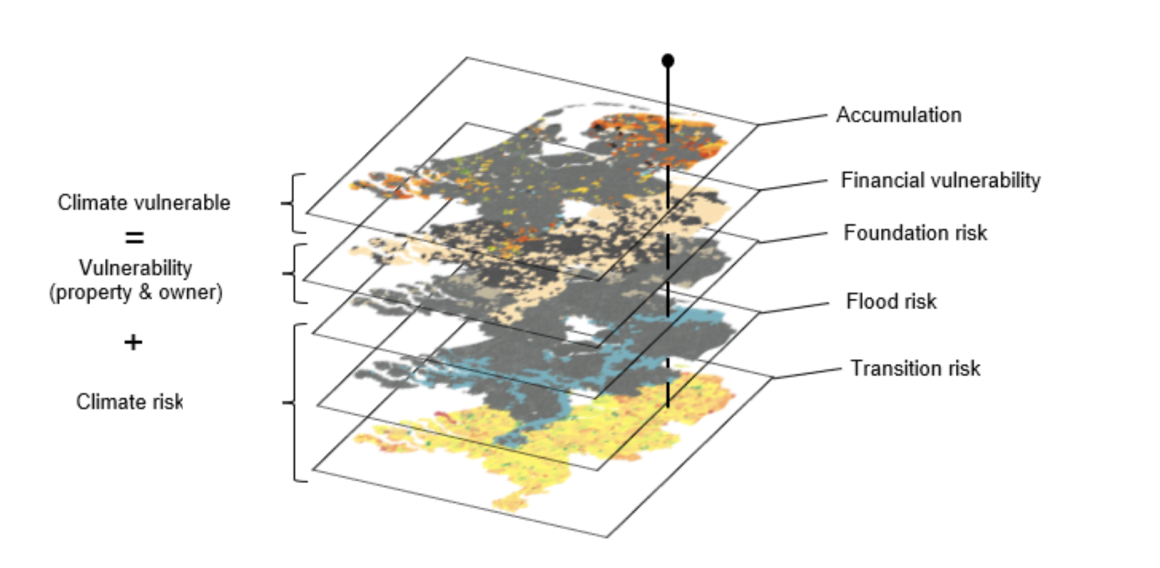

- A granular neighbourhood-level assessment of climate risks for households is crucial to find out where risks are most urgent.

- ABN AMRO proposes multiple solutions to identify and deal with climate risks to households.

It is not the disaster of large floods, but the stacking of smaller damage from climate change that will likely become too much for homeowners in climate-vulnerable neighbourhoods.

With climate change threatening our long-term existence, news stories on the implications of dramatic flooding get a lot of attention. Our ABN AMRO study finds, however, that it is not high-impact events that are likely to hurt people and communities but rather the co-occurrence of small-impact, high-probability events, especially if they happen in neighbourhoods that are also financially less resilient.

Global flood risk maps are often based on the height of land relative to sea level. On such maps, the Netherlands is typically portrayed as the most vulnerable country in the world to flood risk; around 60% of the population and its economy are located below (or far below) sea level.

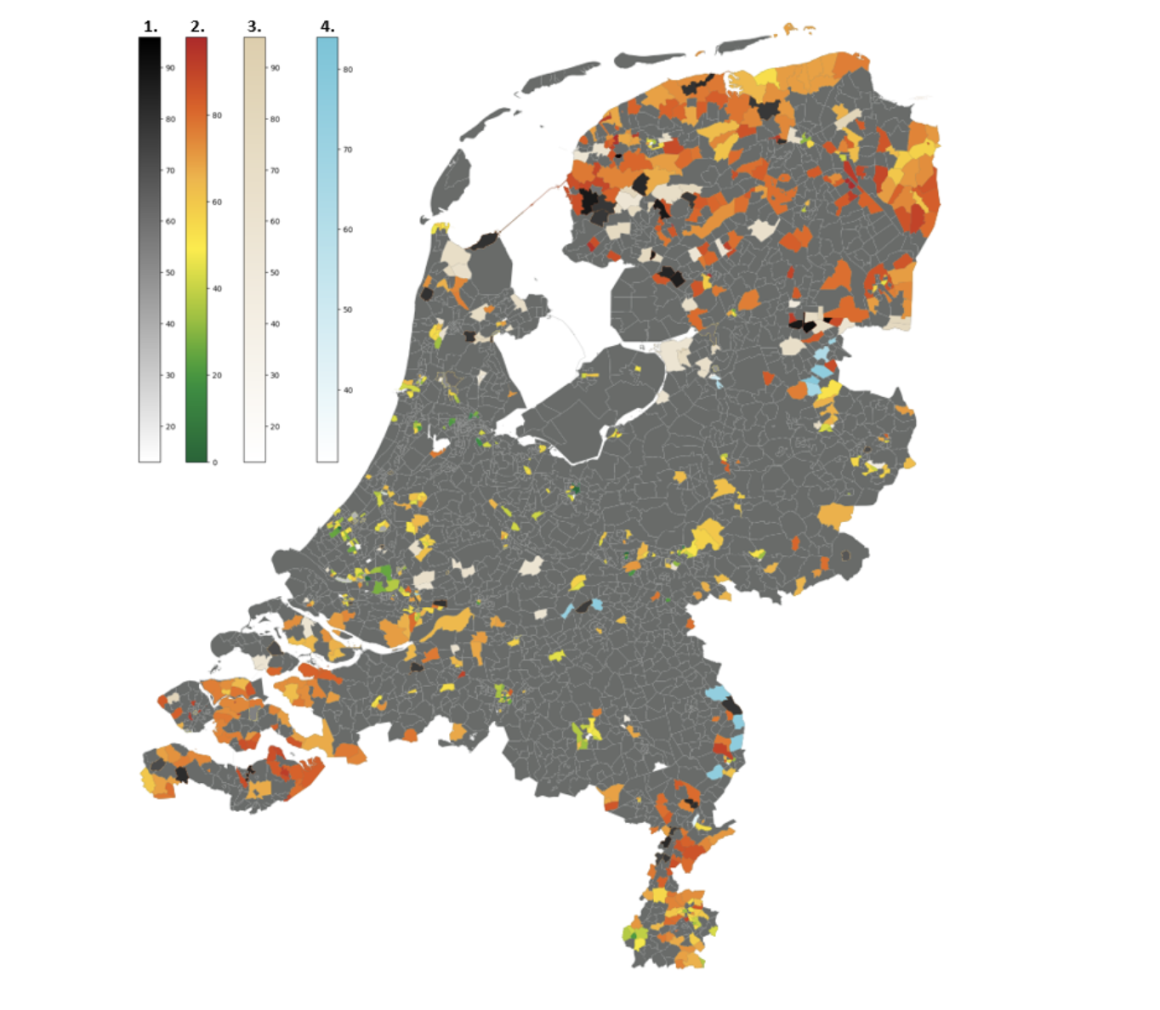

Instead, a troubling issue is the combination of heavy rainfall, rotting foundations and the cost of refurbishing homes to achieve energy neutrality. We have identified 900 neighbourhoods (of a total of 3,000 neighbourhoods in the Netherlands) where households face one of these three costly climate and/or policy risks and are unlikely to be able to cover these costs. In 90 of these neighbourhoods, homeowners face multiple costly climate risks. We have identified these neighbourhoods and proposed concrete solutions for governments, banks and other stakeholders to prevent unaffordable damage for homeowners in these areas.

As the map shows, climate-vulnerable neighbourhoods are mainly located in the country’s periphery. Here, subsidence and/or the high costs of refurbishing to energy neutrality create the most urgency, while properties are of below-average value and homeowners have below-average income. The repair costs are high for both risks. Repairing foundations costs around €60,000 to €100,000 per household, and refurbishing a low energy efficiency home to be energy efficient costs around €35,000 per homeowner.

For low-value properties (up to €300,000), these costs may not be worth the investment and homeowners with below-average income (less than €30,000) may not be able to get a loan for the repairs. While these costly measures for climate adaptation and mitigation can be disastrous for an individual homeowner, the likelihood of a macroeconomic shock arising from these phenomena is small. We estimate that between 2 and 25% of financially vulnerable homeowners face at least one of these climate and/or policy hurdles. However, regions where these issues concentrate are at risk of economic shocks, as second-round effects may spill over to citizens who were not directly affected. Here, the government and other stakeholders need to provide liquidity aid. We propose the following solutions to identify and deal with climate risks to households:

1. Identify climate-vulnerable neighbourhoods

As policymakers need to prioritize their attention, the first thing to do is identify where households are most vulnerable. Stacking climate risk maps with economic risk maps makes the neighbourhoods that require the most attention visible.

2. Adjust values to ‘climate risk corrected’ values

The first painful measure that needs to be taken ensures homes are priced at their actual – climate risk corrected – value. Currently, this is not the case for physical climate risks, implying that the burden of future adaptation costs will be borne solely by home buyers and not sellers. Clear communication between buyers and sellers on the risks will create a price deduction that enables buyers to finance recovery. Communication based on granular risk maps will also prevent unjustified risk premiums on properties that are in non-risky areas.

“We have invested a lot in this research and we are already seeing that many municipalities and homeowners are requesting the details of their neighbourhood from us,” says ABN AMRO CEO Robert Swaak. “With that, we start the process of making the risks part of the knowledge of the buyer and seller. And by doing this, we are also contributing to economic and societal stability, in line with our purpose.”

3. Prevent vulnerable households from moving to risk-prone neighbourhoods

Once prices have adjusted to reflect climate risks, there will be neighbourhoods where houses become more affordable than before. Home buyers may perceive this price deduction as an opportunity to move to these regions, not realizing the potentially high adaptation costs in the near future. Here, mortgage providers have a duty of care to prevent financially vulnerable households from moving to climate-risky neighbourhoods by taking the financing of future adaptation costs into account.

4. Prevent financial lock-in when multiple risks occur

In neighbourhoods where both foundation repairs and energy investments are needed, homeowners could end up locked in financially if they invest their savings in energy efficiency but are not able to restore their foundations. In this case, low-value properties, in particular, may end up as stranded assets as homeowners go bankrupt. In neighbourhoods where these multiple issues are at play, solutions that simultaneously take care of both issues should be considered. New foundations that include geothermal heating could be a solution, as this single investment both increases energy efficiency and protects against value loss from subsidence.

5. Provide public funds for most vulnerable neighbourhoods

Our study found 19 neighbourhoods where multiple risks occur, homeowners are financially vulnerable, and more than 60% of properties are owner-occupied. In these neighbourhoods, regional impacts may spill over to non-impacted homeowners and the government, therefore, needs to step in with a social repair fund to tackle these issues holistically.

By: Sandra Phlippen (Chief Economist, ABN AMRO) and Bram Vendel (Economist and data scientist, ABN AMRO)

Originally publshed at: World Economic Forum